Back Market Update October 2021

September 30, 2021

Mortgage News>> Market Update October 2021

Check Today’s Rates for Mortgage and Refinance

GOOD TIME TO BUY?

In a study of consumer sentiment conducted by the University of Michigan, only 29% of those polled stated it was a good time to purchase a home. That is down more than 50% from March, and at its lowest point since 1982. Reason for the rapid decline in home purchase sentiment; soaring property prices. – Bloomberg.com

UNEXPECTED SURGE IN EXISTING HOME SALES

The market was predicting a 1% increase in existing home sales and got 8.1% in August. After a two-month slide, existing home sales soared with an influx in housing inventory and a slight pullback in home prices.

“Rising inventory and moderating price conditions are bringing buyers back to the market,” said Lawrence Yun, NAR’s chief economist. “Affordability, however, remains challenging as home price gains are roughly three times wage growth.”

Home prices in July were up nearly 20% nationally year over a year, according to the latest S&P Case-Shiller home price index, but that is a three-month average going back to May. The increase in supply has lowered the number of bidding wars, according to real estate agents.

Sales rose the most in the least-expensive regions, namely the Midwest and South, reflecting how the shift to remote work in some industries gave buyers an incentive to relocate.

“The more moderately priced regions of the South and Midwest are experiencing the stronger signing of contracts to buy, which is not surprising,” Yun said. “This can be attributed to some employees who have the flexibility to work from anywhere, as they choose to reside in more affordable places.”

In the Midwest, sales rose 10.4% monthly and were down 5.9% from August 2020. In the South, pending sales increased 8.6% monthly and dropped 6.3% annually.

Sales in the West rose 7.2% monthly and were down 9.2% from a year prior. Pending sales rose 4.6% in the Northeast month to month but were down 15.8% from a year ago. – cnbc.com

One month is not a trend, but is the unexpected surge in existing home sales a sign of a pending pullback, or correction? With the recent interest rate increase and unsustainable home appreciation, the housing market is beginning to show signs of strain. If the economy can stay strong, demand will stay high, even if cooling.

HOME PRICES SET ANOTHER RECORD

The latest S&P Corelogic Case-Shiller National Home Price Index Report showed home pricing up a whopping 19.7% annually in July. That marks the fourth consecutive month that home prices have set a record.

“The last several months have been extraordinary not only in the level of price gains but in the consistency of gains across the country,” Craig Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI, said in a statement.

For the 26th straight month, Phoenix recorded the highest year-over-year home price increase, at 32.4%. San Diego was second with 27.8% and Seattle was third, with a 25.5% increase.

“In July, all 20 cities rose, and 17 gained more in the 12 months ended in July than they had gained in the 12 months ended in June,” Lazzara said in a statement. “Home prices in 19 of our 20 cities now stand at all-time highs, with the sole outlier (Chicago) only 0.3% below its 2006 peak. This month, New York joined Boston, Charlotte, Cleveland, Dallas, Denver, and Seattle in recording their all-time highest 12-month gains. Price gains in all 20 cities were in the top quintile of historical performance; in 15 cities, price gains were in the top five percent of historical performance.”

“There’s a surge of millennials approaching the prime home-buying age and are experiencing more flexibility to expand their search locations,” CoreLogicdeputy chief economist Selma Hepp said in a statement. “Additionally, there are move-up buyers with larger budgets who are relocating to more affordable areas where they’re financially able to outbid local residents. Taken together, these factors have created a double-whammy for home price growth.”

“Home price growth remained scorching hot as the housing market entered the dog days of summer, but data released in the weeks since indicate cooler days in the months to come,” Matthew Speakman a Zilloweconomist said in a statement. “The tight market conditions that have fueled the skyrocketing prices are finally showing signs of loosening. For-sale inventory levels charted their fourth consecutive monthly increase in August, and sellers appear to be taking a less aggressive approach when putting their homes on the market. Price growth remains about as hot as ever, but the housing market is gradually retreating towards a more balanced state.” – housingwire.com

The chain of record-breaking housing prices is coming to an end. It was a historical run, but there are growing signs of pricing pressure, likely leading to a housing market slow down. Even with a slowdown, the market is anticipated to be hot for the foreseeable future.

HOUSING PEAK

Pending home sales were up 6% in the four weeks that ended September 5th according to a recent Redfin study. Contracts were down 9%. The number of homes that sold for over list price dropped from 55% to 50%. Nearly 5% of listed homes posted a price reduction. – housingwire.com

It is evident that the housing market is cooling, and likely at its peak. The economy now as a whole will likely dictate the fate of the housing market. Will prices plateau or will there be a correction? It all comes down to the economy.

UNFAVORABLE JOB NUMBERS

Analysts were anticipating 725,000 new jobs in August and got a meager 235,000 new jobs. The recent surge of the Delta variant is taking much of the blame for the disappointing job numbers.

THE MOST OVERVALUED HOUSING MARKETS

Florida Atlantic University and Florida International University recently issued a study on the nation’s most overvalued housing markets.

Boise, Idaho – 80.64%

Austin, Texas – 50.72%

Ogden, Utah – 49.70%

Provo, Utah – 46.16%

Detroit, Mich. – 45.57%

Spokane, Wash. – 45.21%

Salt Lake City, Utah – 42.41%

Phoenix, Ariz. – 42.31%

Las Vegas, Nev. – 41.88%

Stockton, Calif. – 38.50%

Note: “Overvalued” is an opinion. If demand stays strong, and/or has a reason to stay strong, the value, while rapidly rising, may be sustainable. Homeowners in most cities, not just in the Top 10, experienced a massive increase in wealth due to appreciation in the last year. Of course, it is not truly “experienced” until you sell. Then what. How will a cooling housing market affect the most “overvalued” markets? Not likely with equality. Those markets that maintain the strongest economies will be more resistant to depreciation.

CASHING OUT

$63 billion in equity was pulled out of housing in just the second quarter of 2021 per a new study from Black Knight. And based on today’s home prices, there is still $9 trillion available (keeping loan to values at 80%).

With the recent surge in mortgage rates, and with the expectation that rates will continue to climb, and appreciation will wane, this may be the last great opportunity to take advantage of one’s home equity at what are still low-interest rates. The are several uses for home equity including debt consolidation, home improvement, or future real estate acquisitions.

NON-OWNER AND 2ND HOME FINANCING JUST GOT LESS EXPENSIVE

Under the final weeks of the Trump administration, the Treasury Department and FHFA capped its acquisition of loans secured by 2nd homes and non-owner-occupied homes to just 7% of the total portfolio. The change caused interest rates to soar on these products as they were forced to find investors in the private market, a win for Wall Street assuming they could handle the demand.

On the 14th of September, the Treasury Department and FHFA reversed course and lifted the 7% cap.

“The suspension of these PSPA requirements recognizes that FHFA has the authority and responsibility for the Enterprises’ safety and soundness and to foster housing finance markets that support sustainable homeownership, and is not intended to stimulate aggregate housing demand given current conditions in the housing market,” the Treasury stated in a Tuesday afternoon press release.

“Home prices have been accelerating rapidly, with the annual rate of national home price growth at multi-decade highs,” the Treasury release continued. “A principal challenge for the U.S. residential housing market today is inadequate housing supply. The Administration is focused on promoting housing stability, which includes advancing housing policies that can sustainably increase the stock of affordable housing units for rent and ownership.” – housingwire.com

A Redfin study reported that the demand for 2nd homes and investment properties was up 84% year over year. The lift of the 7% cap increases the likelihood that demand will remain strong.

U.S. NATIONAL DEBT

The U.S. now stands at $28.817 Trillion and climbing. To put that into perspective, the entire U.S. GDP in 2020 was $20.93 trillion. Not raising the debt limit, the U.S. ability to borrow more money to pay debts would be an economic catastrophe. Neither political party has any ability to curb spending, so how are you going to pay down the debt without raises taxes. You cannot. It is inevitable that taxes will go up, just a question of who is going to pay.

GENEVA FINANCIAL, LLC NOW LICENSED IN 45 STATES

Alabama, Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Washington D.C., West Virginia, Wisconsin, Wyoming

Pending: North Dakota

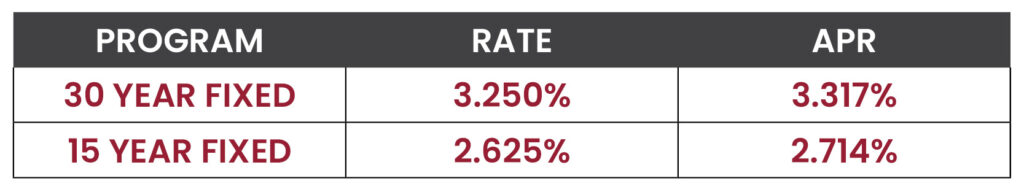

RATE WATCH – HIGHER

Interest rates as of 09/29/2021. Conforming interest rates. Interest rates and APR based on loan amounts not to exceed $548,250. Loan to value not to exceed 80%. 740+ credit score. Owner occupied only. Purchase and rate in term refinances. Not all applicants will qualify. Call today for your individual scenario rate quote.