Back Should I Refinance My Mortgage?

March 21, 2021

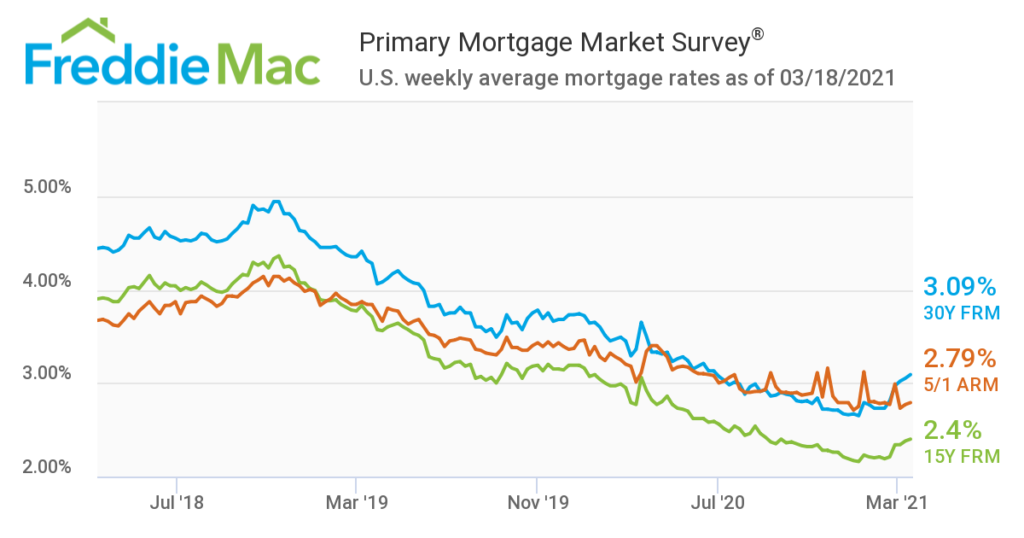

You may be wondering if now is still a good time to refinance your mortgage? If you haven’t heard, mortgage rates are on the rise but they are still at historic lows.

Many Americans may still be able to benefit from refinancing their mortgage. Try our interactive mortgage refinance calculator to see if this may be right for you:

How do I know if this is the right time to refinance my mortgage?

If your home or current mortgage meets one or more of these three conditions, it’s a good time to consider refinancing.

- Increased home value. If conditions in your local housing market have increased your home’s value, your equity went up, too. With high equity, you could get a new loan on better terms. Or you can convert that equity into cash to use however you like.

- Interest rates are low. As a general rule, if you can get an interest rate at least half a percent lower than what you’re currently paying, it’s a good idea to consider refinancing. If you can get more than a percent, it’s a great idea. A lower rate could get you a shorter term, lower monthly payments, savings over the life of the loan – maybe even all three.

- Your current mortgage is relatively new. In the early part of many mortgages, most of the monthly payment goes toward interest. If you can get a new mortgage that applies more of your payments toward the principal, that’s good. You’ll build equity faster. It’s like paying money to yourself.

As you can see in the chart below, mortgage rates are still at a historic low in comparison to the last three years.

What are the benefits of refinancing?

Refinancing isn’t just about monthly savings. A lower rate can help you pay your loan off faster or possibly allow you to access cash from your home’s equity with no change in payment at all. There are many options to pursue.

- Reducing Term (pay it off faster)

- Debt Consolidation

- FHA and VA Streamline (no cash-out, easier qualifying)

- Removing Mortgage Insurance

- Cash-Out Refinance (Tap Into Your Home’s Equity)